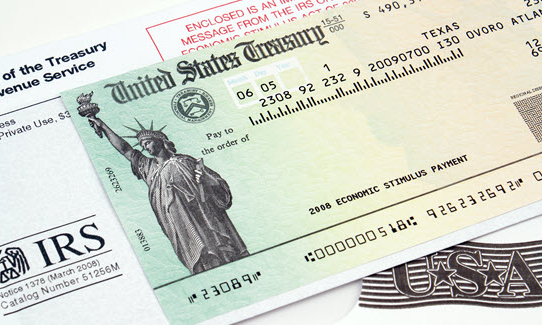

Veterans who receive federal benefits from the Department of Veterans Affairs will not be required to file with the IRS to get their COVID-19 stimulus checks despite previous concerns.

According to the IRS, VA recipients will get “a $1,200 Economic Income Payment with no further action needed on their part. Timing on the payments is still being determined.” This announcement comes after previous statements from lawmakers and veterans groups warning that a large number of veterans and their family members could miss out on the direct payments because they usually aren’t required to file tax returns.

“Additional programming work remains, but this step simplifies the process for VA recipients to quickly and easily receive these $1,200 payments automatically,” said IRS Commissioner Chuck Rettig.

“We deeply appreciate the sacrifices and service to our country by each and every veteran and their families, as well as the assistance of VA and the Bureau of Fiscal Services in this effort.”

VA recipients will receive their stimulus check in the same way they receive their current benefits. Those who receive benefits and also have a dependent under the age of 17 will need to use the IRS non-filter tool to ensure they receive their $500 per child included in the CARES Act.

To the veteransintrucking.com webmaster, Your posts are always informative.

To the veteransintrucking.com owner, Thanks for the well-organized and comprehensive post!

To the veteransintrucking.com admin, Your posts are always informative and well-explained.

Dear veteransintrucking.com owner, You always provide great examples and case studies.

Hello veteransintrucking.com webmaster, You always provide great examples and case studies.

Dear veteransintrucking.com administrator, Thanks for the well-researched post!

Hello veteransintrucking.com admin, You always provide useful tips and best practices.

Dear veteransintrucking.com administrator, Thanks for the in-depth post!

Hello veteransintrucking.com administrator, Your posts are always well-balanced and objective.

Hello veteransintrucking.com administrator, You always provide useful links and resources.

japanese type beat

Dear veteransintrucking.com owner, Thanks for the great post!

Hello veteransintrucking.com admin, You always provide in-depth analysis and understanding.

japanese

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You clearly know what youre talking about, why waste your intelligence on just posting videos to your blog when you could be giving us something enlightening to read?

Appreciate you sharing, great blog.Thanks Again.

Thanks for sharing, this is a fantastic article.Really looking forward to read more.

Wow, great post.Much thanks again. Awesome.

A round of applause for your blog.Much thanks again.

Great article.Really looking forward to read more. Awesome.

Fantastic blog article.Really looking forward to read more. Great.

Thanks-a-mundo for the article post. Fantastic.

I loved your article post.Really looking forward to read more. Really Great.

Thanks so much for the post.Thanks Again. Much obliged.

Im grateful for the post. Want more.

Thanks a lot for the post.Thanks Again.

A round of applause for your blog article. Really Cool.

Enjoyed every bit of your post.Thanks Again. Keep writing.

I cannot thank you enough for the blog post. Really Cool.

Thanks for the blog article.Really thank you! Cool.

I loved your article post.Really looking forward to read more. Great.

Awesome article post.Really thank you! Much obliged.

Fantastic blog article.Much thanks again. Keep writing.

Say, you got a nice article.Much thanks again. Keep writing.

Thanks for the article post.Thanks Again. Really Cool.

Im grateful for the article post.Thanks Again. Really Great.

Very good blog post.Really looking forward to read more. Fantastic.

Thanks so much for the article.

Im obliged for the post.Really thank you! Great.

Appreciate you sharing, great post.Much thanks again. Cool.

I really like and appreciate your article. Will read on…

Very good blog. Great.

I think this is a real great blog article.Really thank you! Keep writing.

I really enjoy the article post.Really looking forward to read more.

Major thankies for the post.Really looking forward to read more. Great.

Appreciate you sharing, great blog.Much thanks again. Much obliged.

Thank you for your article post.Really looking forward to read more. Really Great.

Great, thanks for sharing this article post. Great.

A round of applause for your blog post.Much thanks again. Really Great.

Im thankful for the article post.Much thanks again. Fantastic.

I really liked your blog article. Cool.

Major thankies for the article post.Really thank you! Awesome.

Very informative blog.Really looking forward to read more. Cool.

Thank you for your blog.Really looking forward to read more. Really Cool.

I am so grateful for your article post.Much thanks again.

I am so grateful for your article.Thanks Again. Fantastic.

I truly appreciate this blog article. Awesome.

wonderful submit, very informative. I’m wondering why the other experts of this sector do not understand this. You should continue your writing. I am sure, you have a huge readers’ base already!

Thanks for sharing, this is a fantastic article post.Much thanks again. Will read on…

I am so grateful for your post.Much thanks again. Fantastic.

Really appreciate you sharing this post.Really looking forward to read more. Cool.

Thanks again for the blog post. Fantastic.

I truly appreciate this article post.Thanks Again. Fantastic.

This is one awesome article post. Want more.

Really enjoyed this blog.Much thanks again. Want more.

I am so grateful for your blog article.Really looking forward to read more. Keep writing.

Thank you for your post.Much thanks again. Really Cool.

Fantastic blog article.Thanks Again. Much obliged.

Major thanks for the post.Much thanks again.

Thank you for your article post.Really looking forward to read more. Great.

I am so grateful for your article post.Thanks Again.

Really appreciate you sharing this article post.Thanks Again. Want more.

Thank you ever so for you post.Much thanks again. Keep writing.

This is one awesome blog article.Really looking forward to read more. Really Cool.

I cannot thank you enough for the article.Really thank you! Great.

I really liked your blog article.Really thank you! Really Cool.

I really enjoy the post.Really thank you! Want more.

Really appreciate you sharing this blog post.Really looking forward to read more. Will read on…

Really appreciate you sharing this article post. Awesome.

A round of applause for your blog article.Much thanks again. Really Cool.

Enjoyed every bit of your post.Thanks Again. Much obliged.

Appreciate you sharing, great blog.Much thanks again. Cool.

Great, thanks for sharing this blog.Really looking forward to read more. Awesome.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks again for the article.Much thanks again. Really Great.

Thanks for the blog.Really looking forward to read more. Will read on…

Great, thanks for sharing this article post.Thanks Again. Fantastic.

Hey, thanks for the blog post.Really looking forward to read more. Fantastic.

Thanks-a-mundo for the blog article. Really Great.

Enjoyed every bit of your blog post. Will read on…

Im grateful for the blog article.Really thank you! Keep writing.

I really enjoy the post.Really thank you! Much obliged.

Great, thanks for sharing this blog post.Much thanks again. Want more.

I truly appreciate this post.Really looking forward to read more. Keep writing.

Appreciate you sharing, great article post.

Thank you ever so for you post. Keep writing.

wow, awesome article post.Thanks Again. Will read on…

Really appreciate you sharing this article post.Much thanks again. Awesome.

wow, awesome blog article.Thanks Again. Really Cool.

Thanks a lot for the post. Much obliged.

Really enjoyed this article post.Much thanks again. Cool.

Really enjoyed this article post.Really thank you!

Great, thanks for sharing this blog article.Really thank you! Fantastic.

Im grateful for the blog article.Much thanks again. Great.

I loved your blog.Really looking forward to read more.

I cannot thank you enough for the blog.Much thanks again. Want more.

Really appreciate you sharing this article post. Cool.

I am so grateful for your blog.Thanks Again. Fantastic.

Say, you got a nice blog.Really looking forward to read more. Much obliged.

I think this is a real great post.

I appreciate you sharing this article.Thanks Again. Awesome.

A big thank you for your post.Really thank you! Keep writing.

I really enjoy the article.Thanks Again. Keep writing.

A round of applause for your blog article.Much thanks again.

Wow, great post.Really thank you! Cool.

Very neat post.Thanks Again. Want more.

Very informative article post.Thanks Again. Really Cool.

Thanks again for the post.Really looking forward to read more. Really Cool.

This is one awesome post.Really looking forward to read more. Great.

Really informative post.Much thanks again. Cool.

I value the blog.Really looking forward to read more. Great.

Major thanks for the article.Much thanks again.

Looking forward to reading more. Great blog article.Much thanks again. Great.

Very good blog.Really looking forward to read more. Keep writing.

To the veteransintrucking.com admin, Your posts are always well-received and appreciated.

A round of applause for your article post.Thanks Again. Want more.

Very informative blog post. Will read on…

I think this is a real great article post.Really looking forward to read more. Will read on…

Thanks-a-mundo for the article.Thanks Again. Much obliged.

Awesome post.Much thanks again. Really Cool.

I am so grateful for your article. Really Great.

Hola! I’ve been following your site for a long time now and finally got the bravery to go ahead and give you a shout out from Dallas Tx! Just wanted to tell you keep up the great job!

Major thankies for the blog post. Great.

Looking forward to reading more. Great blog article.Much thanks again. Cool.

I really enjoy the article post.Really looking forward to read more.

Your creating persistently opens my intellect to new alternatives. Thanks!

Say, you got a nice blog post.Much thanks again. Want more.

I loved your article.Much thanks again. Keep writing.

I appreciate you sharing this blog post.Really thank you! Really Great.

Very neat article.Really looking forward to read more.

I really like and appreciate your blog article.Really thank you! Great.

Really enjoyed this blog. Want more.

Thanks for the blog article.Thanks Again. Want more.

Your passion for the topic genuinely shines by means of as part of your composing.

Very neat blog.Really thank you! Will read on…

Web Design Bundaberg Shop, 216 Bourbong Street, Bundaberg Central QLD 4670, Email: [email protected], Phone: 07 3067 8955

Thanks a lot for the blog article.Much thanks again.

Appreciate you sharing, great post. Keep writing.

Thank you for your blog.Really looking forward to read more. Cool.

I value the way you broke down complicated principles into simple phrases. It created it less difficult to know.

Thanks-a-mundo for the blog.Really thank you! Great.

Your crafting is like a mentor’s guidance, and i am listed here to absorb everything.

You have cultivated a community of curious minds eager to learn jointly.

You have turned me into a lifelong learner, all owing to your incredible posts.

I loved your article post.Much thanks again. Really Great.

Very informative article post.Thanks Again. Cool.

I really enjoy the article. Really Great.

Really informative article post. Keep writing.

That is precisely what I had been looking for. Thanks for furnishing these a comprehensive guideline.

Your posts really are a goldmine of practical information and actionable ideas.

Your put up was so perfectly-researched that I realized a thing new with just about every paragraph. Thank you for sharing your knowledge with us.

Thanks-a-mundo for the blog post. Great.

I really like and appreciate your article post.Thanks Again. Want more.

I really like and appreciate your article post.Really looking forward to read more. Cool.

Muchos Gracias for your post.

Great, thanks for sharing this blog article.Really thank you! Fantastic.

I really like and appreciate your blog. Really Great.

Very good post.Really looking forward to read more. Cool.

I appreciate you sharing this blog.Thanks Again. Much obliged.

I think this is a real great blog.Really looking forward to read more. Much obliged.

Thank you ever so for you blog.Really looking forward to read more.

I am grateful with the refreshing perspectives you bring to every subject. http://prsync.com/web-design-bundaberg-shop/web-design-bundaberg-shop-transforming-your-online-presence-from-sunburnt-to-stunning-4141176/

wow, awesome blog post.Really looking forward to read more. Really Great.

Your web site deserves each of the recognition for the worth it provides to audience’ life. http://www.oakey.com.au/queensland/216-bourbong-street-bundaberg-central/professional-development/web-design-bundaberg-shop

I cannot thank you enough for the blog article.Really thank you! Want more.

Your insights are getting to be A vital A part of my understanding journey. https://www.smea.org.au/queensland/bundaberg-central/business-consultants/web-design-bundaberg-shop

Very neat article.Much thanks again. Want more.

Hello veteransintrucking.com administrator, Good job!

Major thanks for the article post.Really looking forward to read more. Will read on…

Really enjoyed this article post.Much thanks again. Much obliged.

Great article.Really looking forward to read more. Much obliged.

I am extremely impressed with your writing skills and also with the layout on your blog. Is this a paid theme or did you customize it yourself? Either way keep up the nice quality writing, it’s rare to see a nice blog like this one nowadays.

Enjoyed every bit of your blog article.Thanks Again. Great.

Hello veteransintrucking.com owner, You always provide great information and insights.

Thanks again for the blog article. Cool.

Fantastic article post.Really looking forward to read more. Much obliged.

Really enjoyed this blog.Thanks Again. Cool.

Muchos Gracias for your article.Much thanks again. Cool.

I am generally impressed by the standard of your producing. You do have a actual reward for speaking complex Thoughts in a means that’s effortless to comprehend.

To the veteransintrucking.com owner, Thanks for the well-researched and well-written post!

Really informative article post. Want more.

Thanks so much for the blog.Really thank you! Want more.

Major thankies for the blog post.Really looking forward to read more. Really Great.

Thank you for your blog article.Really thank you! Want more.

I loved your blog post.Really looking forward to read more. Awesome.

Great post.

I value the article. Great.

Really informative article post.Thanks Again. Keep writing.

I really enjoy the article post.Really looking forward to read more. Great.

I appreciate you sharing this blog post.Much thanks again.

Enjoyed every bit of your blog post.Really looking forward to read more. Awesome.

Thank you ever so for you post.Much thanks again. Cool.

Say, you got a nice blog article.

Pretty nice post. I just stumbled upon your blog and wanted to say that I have really enjoyed browsing your blog posts. In any case I’ll be subscribing to your feed and I hope you write again soon!

I think this is a real great article post.Thanks Again. Cool.

I love the way you employed humor to maintain your readers engaged. It designed the publish far more satisfying to read.

Your blog site is my guilty satisfaction – I am unable to get sufficient of it!

I love how you were being capable of simplify these kinds of a posh matter. It created it a lot easier to be aware of.

Major thanks for the article post.Thanks Again. Fantastic.

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Appreciate it!

Looking forward to reading more. Great article post.Much thanks again. Really Great.

Hi friends, nice article and pleasant arguments commented here, I am in fact enjoying by these.

Thanks-a-mundo for the article.Really thank you! Much obliged.

I loved your blog post.Really looking forward to read more. Great.

Wonderful beat ! I wish to apprentice at the same time as you amend your web site, how can i subscribe for a blog site? The account aided me a appropriate deal. I were tiny bit familiar of this your broadcast provided vibrant transparent concept

Great blog article. Want more.

I appreciate you sharing this post.Really thank you! Cool.

Im obliged for the blog post.Really thank you! Will read on…

Enjoyed every bit of your article.Much thanks again. Really Cool.

I have been surfing online more than three hours these days, yet I never found any interesting article like yours. It’s lovely worth enough for me. In my opinion, if all site owners and bloggers made just right content as you did, the internet might be much more useful than ever before.

Im grateful for the article.Really thank you! Fantastic.

I truly appreciate this article post.Really looking forward to read more. Keep writing.

Enjoyed every bit of your article. Fantastic.

Appreciate you sharing, great blog article. Awesome.

¿dónde comprar medicamentos en Bélgica? Nepenthes Ingolstadt médicaments livraison express en France

I loved your blog post. Really Cool.

Your publish was a joy to study. There is a authentic expertise for writing and it shows with your operate.

Your post was a great illustration of how to write down with authenticity. You’re not fearful to get yourself and it exhibits inside your operate.

Your weblog is my responsible pleasure – I can not get enough of it!

I cannot thank you enough for the article.Really thank you! Much obliged.

Loving the info on this website , you have done outstanding job on the blog posts.

pin up az: pin up 360 – pin-up oyunu

Very neat blog post.

pin up azerbaycan yukle https://azerbaijancuisine.com/# pin up yukle

pin up casino

I think this is a real great article.Thanks Again. Great.

Great article post. Want more.

I really enjoy the blog post. Really Great.

I like the helpful information you provide in your articles. I’ll bookmark your blog and check again here frequently. I am quite certain I’ll learn many new stuff right here! Best of luck for the next!

mexican online pharmacies prescription drugs: mexican pharmacy – reputable mexican pharmacies online

A round of applause for your post.Much thanks again. Want more.

https://northern-doctors.org/# mexico drug stores pharmacies

medication from mexico pharmacy Mexico pharmacy that ship to usa mexican drugstore online

buying from online mexican pharmacy: northern doctors pharmacy – buying from online mexican pharmacy

To the veteransintrucking.com admin, Your posts are always well-written and engaging.

https://northern-doctors.org/# mexican pharmacy

buying from online mexican pharmacy: mexican pharmacy – buying prescription drugs in mexico

https://northern-doctors.org/# buying prescription drugs in mexico

mexican online pharmacies prescription drugs: reputable mexican pharmacies online – mexico drug stores pharmacies

buying prescription drugs in mexico online northern doctors pharmacy buying prescription drugs in mexico

Say, you got a nice blog post.Thanks Again.

mexico drug stores pharmacies: mexican pharmacy online – mexican pharmaceuticals online

https://northern-doctors.org/# mexico drug stores pharmacies

This submit resonated with me on numerous amounts. Effectively carried out! https://justpaste.me/EtoL1

mexican drugstore online: northern doctors pharmacy – buying from online mexican pharmacy

This facts is just what I had been looking for. Thanks! https://sites.google.com/view/insightfulupdate/blog/web-design-bundaberg

https://northern-doctors.org/# п»їbest mexican online pharmacies

mexico drug stores pharmacies: mexican pharmacy online – purple pharmacy mexico price list

Thanks for sharing, this is a fantastic article.Really thank you! Fantastic.

buying prescription drugs in mexico: Mexico pharmacy that ship to usa – mexico pharmacies prescription drugs

https://northern-doctors.org/# mexican online pharmacies prescription drugs

Your insights are like a flashlight in the darkness of misinformation. https://www.dropbox.com/scl/fi/uu6hqfscboxeq7a1ov91h/Top-Web-Designers-for-Bundaberg-Businesses-in-Australia.paper?rlkey=84ztpy5br9mdffqarub5tjc1j&dl=0

best online pharmacies in mexico mexican pharmacy northern doctors reputable mexican pharmacies online

mexican drugstore online: mexican pharmacy online – mexican border pharmacies shipping to usa

https://northern-doctors.org/# mexican pharmacy

medication from mexico pharmacy: mexican pharmacy – mexico pharmacies prescription drugs

mexican rx online: mexican northern doctors – п»їbest mexican online pharmacies

http://northern-doctors.org/# best online pharmacies in mexico

Major thankies for the blog article.Really looking forward to read more. Want more.

best online pharmacies in mexico: northern doctors pharmacy – medication from mexico pharmacy

mexican mail order pharmacies: northern doctors pharmacy – mexico drug stores pharmacies

https://northern-doctors.org/# mexican pharmaceuticals online

buying prescription drugs in mexico Mexico pharmacy that ship to usa mexican drugstore online

medication from mexico pharmacy: mexican northern doctors – buying prescription drugs in mexico

Appreciate you sharing, great article.Much thanks again. Really Cool.

To the veteransintrucking.com admin, You always provide key takeaways and summaries.

https://northern-doctors.org/# п»їbest mexican online pharmacies

mexican drugstore online: mexican pharmacy northern doctors – mexico pharmacies prescription drugs

buying prescription drugs in mexico online northern doctors pharmacy mexican drugstore online

medicine in mexico pharmacies: mexican pharmacy online – mexican mail order pharmacies

https://northern-doctors.org/# mexico pharmacies prescription drugs

mexican drugstore online: northern doctors – п»їbest mexican online pharmacies

https://northern-doctors.org/# medicine in mexico pharmacies

I think this is one of the most significant information for me. And i’m glad reading your article. But wanna remark on few general things, The website style is great, the articles is really excellent : D. Good job, cheers

buying from online mexican pharmacy: mexican pharmacy northern doctors – mexican pharmacy

http://northern-doctors.org/# buying prescription drugs in mexico online

mexico drug stores pharmacies mexican northern doctors buying prescription drugs in mexico online

buying from online mexican pharmacy: mexican pharmacy online – buying from online mexican pharmacy

reputable mexican pharmacies online: mexican pharmacy northern doctors – pharmacies in mexico that ship to usa

https://northern-doctors.org/# mexico drug stores pharmacies

purple pharmacy mexico price list: buying prescription drugs in mexico online – mexico pharmacies prescription drugs

https://northern-doctors.org/# mexican rx online

buying from online mexican pharmacy: mexican drugstore online – mexico pharmacy

mexican border pharmacies shipping to usa: buying prescription drugs in mexico – pharmacies in mexico that ship to usa

https://northern-doctors.org/# mexico drug stores pharmacies

I actually relished looking through your submit. The way you discussed all the things was really obvious and concise.

mexican pharmacy: buying from online mexican pharmacy – mexico drug stores pharmacies

mexican online pharmacies prescription drugs northern doctors pharmacy medicine in mexico pharmacies

medication from mexico pharmacy: northern doctors pharmacy – mexico drug stores pharmacies

https://northern-doctors.org/# mexican online pharmacies prescription drugs

mexico pharmacies prescription drugs: northern doctors – best online pharmacies in mexico

https://northern-doctors.org/# п»їbest mexican online pharmacies

We need to build frameworks and funding mechanisms.

mexican rx online: mexican pharmacy northern doctors – mexican drugstore online

Hello veteransintrucking.com admin, Thanks for the well-researched and well-written post!

mexico drug stores pharmacies: mexican pharmacy northern doctors – buying prescription drugs in mexico

I love the way you addressed prevalent misconceptions Within this put up. It’s important to set the report straight on these issues.

https://northern-doctors.org/# medication from mexico pharmacy

I am very happy to look your post. Thanks a lot and i am taking a look ahead to touch you.

buying prescription drugs in mexico: northern doctors pharmacy – buying prescription drugs in mexico

http://northern-doctors.org/# mexican pharmaceuticals online

best online pharmacies in mexico northern doctors mexican border pharmacies shipping to usa

п»їbest mexican online pharmacies: mexican pharmacy – mexican rx online

Your web site deserves every one of the recognition for the worth it provides to viewers’ life.

mexican online pharmacies prescription drugs: Mexico pharmacy that ship to usa – purple pharmacy mexico price list

https://northern-doctors.org/# medicine in mexico pharmacies

Your posts strike an ideal balance amongst informative and interesting.

buying prescription drugs in mexico online: northern doctors – mexico pharmacy

http://cmqpharma.com/# purple pharmacy mexico price list

mexican mail order pharmacies

buying from online mexican pharmacy mexican mail order pharmacies mexico pharmacy

Appreciate you sharing, great article post. Much obliged.

buying prescription drugs in mexico mexico drug stores pharmacies mexico drug stores pharmacies

mexican drugstore online

http://cmqpharma.com/# medication from mexico pharmacy

medication from mexico pharmacy

mexico drug stores pharmacies cmqpharma.com best online pharmacies in mexico

pharmacies in mexico that ship to usa: mexican pharmaceuticals online – mexican pharmacy

buying prescription drugs in mexico online mexico pharmacy medication from mexico pharmacy

mexican pharmacy mexican online pharmacy reputable mexican pharmacies online

buying prescription drugs in mexico online cmq mexican pharmacy online mexican border pharmacies shipping to usa

I think this is a real great post. Will read on…

purple pharmacy mexico price list cmqpharma.com mexico drug stores pharmacies

medication from mexico pharmacy mexico pharmacy mexico drug stores pharmacies

mexico pharmacy cmq mexican pharmacy online mexican drugstore online

I cannot thank you enough for the blog. Will read on…

Your crafting is so apparent and concise that even a novice could understand this matter. Thank you for which makes it obtainable. https://ourclass.mn.co/posts/60836014?utm_source=manual

Your creating is enlightening and engaging. I often find out one thing new from the posts. https://www.behance.net/gallery/201762221/3D-Logo-Design-in-Bundaberg

I am grateful to possess stumbled on your blog site. What a uncover! https://bundaberg-s-web-design-elite-companies-in-aust.teachable.com/p/bundaberg-s-web-design-elite-companies-in-australia

Your devotion to sharing useful knowledge is truly admirable. https://www.edocr.com/v/dnzrzwkd/rima69547/leading-web-design-services-in-bundaberg-qld-au

hi!,I love your writing so so much! proportion we keep in touch more approximately your post on AOL? I need an expert in this space to unravel my problem. May be that is you! Looking forward to see you.

https://cmqpharma.online/# mexican mail order pharmacies

buying from online mexican pharmacy

mexican pharmacy cmq pharma mexican pharmacy mexican online pharmacies prescription drugs

Hello! I just want to offer you a huge thumbs up for your great info you’ve got right here on this post. I am coming back to your site for more soon.

Thank you ever so for you post.Thanks Again. Fantastic.

Major thankies for the post. Awesome.

Appreciate you sharing, great article post.Really thank you! Awesome.

Oh my goodness! Impressive article dude! Many thanks, However I am going through issues with your RSS. I don’t understand the reason why I can’t subscribe to it. Is there anyone else having the same RSS issues? Anyone that knows the solution will you kindly respond? Thanx!!

Major thanks for the post.Really thank you! Fantastic.

Im thankful for the article.Thanks Again.

Say, you got a nice post.Really looking forward to read more. Fantastic.

Your writing is usually a breath of fresh air. It really is good to browse something that’s not simply regurgitating the standard details. oshawa roofing companies https://identitynewsroom.com/business/roofing-companies-in-oshawa/ roofers in oshawa

Thanks-a-mundo for the article.Much thanks again. Awesome.

After looking over a number of the articles on your website, I really like your technique of writing a blog. I saved it to my bookmark website list and will be checking back soon. Please check out my website too and let me know what you think.

I respect the hassle you set into this submit. It is really apparent that you’re obsessed with this issue. oshawa roofing https://pencraftednews.com/top-rated-roofing-contractors-in-oshawa/ roofing oshawa ontario

Your passion for Studying is infectious. I am proud being a component within your Local community. roofing oshawa ontario https://johnmathewswrite.livepositively.com/oshawa-roof-repair-companies-you-can-trust-in-canada/ oshawa roofing companies

При строительстве автомоек под ключ особое внимание уделяется экологичности и экономии ресурсов. Все работы выполняются в соответствии с последними трендами в области моечного бизнеса.

I value the blog article. Keep writing.

Thanks-a-mundo for the blog article.Really looking forward to read more. Want more.

Muchos Gracias for your post. Awesome.

After looking at a few of the articles on your web site, I honestly like your technique of writing a blog. I saved as a favorite it to my bookmark website list and will be checking back soon. Please visit my web site as well and tell me what you think.

Thanks so much for the blog article. Really Great.

Thanks so much for the blog.Much thanks again. Will read on…

Great, thanks for sharing this article. Will read on…

Im grateful for the blog.Thanks Again. Cool.

Really appreciate you sharing this article.Really thank you! Great.

Wow, great article post.Much thanks again. Awesome.

Fantastic post.Much thanks again. Will read on…

Excellent blog you’ve got here.. It’s hard to find quality writing like yours these days. I seriously appreciate people like you! Take care!!

A round of applause for your blog.Really looking forward to read more. Will read on…

Nice to meet you! We are a online retailer since 1988. Welcome to Elivera 1988-2023. EliveraGroup sells online natural cosmetics, beauty products, food supplements. We connect people with products and services in new and unexpected ways. The company ELIVERAGroup, is a Retailer, which operates in the Cosmetics industry. ELIVERA was established in 1988. © ELIVERA LTD was established in 2007. The first project was in 1988. It was carried out in trade with Russia, Belarus, Ukraine, Belgium, Hungary, Poland, Lithuania, Latvia and Estonia.

Nice to meet you! We are a online retailer since 1988. Welcome to Elivera 1988-2023. EliveraGroup sells online natural cosmetics, beauty products, food supplements. We connect people with products and services in new and unexpected ways. The company ELIVERAGroup, is a Retailer, which operates in the Cosmetics industry. ELIVERA was established in 1988. © ELIVERA LTD was established in 2007. The first project was in 1988. It was carried out in trade with Russia, Belarus, Ukraine, Belgium, Hungary, Poland, Lithuania, Latvia and Estonia.

Muchos Gracias for your post.Much thanks again. Keep writing.

Hello, I think your blog might be having browser compatibility issues. When I look at your website in Chrome, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other than that, awesome blog!

Fantastic piece of writing here1

Thank you ever so for you blog article.Really looking forward to read more. Much obliged.

Wow, amazing blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your site is wonderful, let alone the content!

Really informative article post.Much thanks again. Keep writing.

Pretty! This was an extremely wonderful article. Many thanks for supplying this information.

I am so grateful for your blog post.Thanks Again. Keep writing.

WoW decent article. Can I hire you to guest write for my blog? If so send me an email!

Appreciate you sharing, great article.Really thank you! Want more.

Im obliged for the article post. Want more.

Thanks for the blog.Much thanks again. Really Cool.

Very neat post.Really thank you! Keep writing.

Im thankful for the blog post.Much thanks again. Cool.

Thank you ever so for you article post.Really thank you! Keep writing.

This article actually helped me with a report I was doing.

Really appreciate you sharing this blog post. Much obliged.

Really enjoyed this blog.Really thank you! Much obliged.

https://artdaily.com/news/171650/Mp3Juice-Review–The-Pros-and-Cons-You-Need-to-Know

Thanks for sharing, this is a fantastic article.Much thanks again. Want more.

Thanks-a-mundo for the article post.Really thank you! Cool.

Enjoyed every bit of your blog article.Really looking forward to read more. Keep writing.

Im thankful for the article post.Really looking forward to read more. Much obliged.

Spot on with this write-up, I actually think this web site needs a lot more attention. I’ll probably be returning to see more, thanks for the info.

Thanks again for the post.Much thanks again. Great.

Good post. I study something more difficult on different blogs everyday. It’s going to always be stimulating to learn content material from other writers and observe a little bit one thing from their store. I’d prefer to use some with the content material on my blog whether you don’t mind. Natually I’ll give you a link in your web blog. Thanks for sharing.

Pretty nice post. I just stumbled upon your weblog and wanted to say that I’ve really enjoyed surfing around your blog posts. After all I’ll be subscribing in your feed and I am hoping you write again very soon!

Fantastic blog post.Much thanks again. Really Cool.

That is a really good tip particularly to those fresh to the blogosphere. Short but very accurate info… Thanks for sharing this one. A must read post!

Very informative article.Really looking forward to read more. Cool.

Looking forward to reading more. Great blog.Thanks Again. Want more.

Spot on with this write-up, I actually believe this website needs much more attention. I’ll probably be returning to read more, thanks for the information!

Great, thanks for sharing this blog. Cool.

Thanks a lot for the article post.Really looking forward to read more. Want more.

Really appreciate you sharing this blog. Really Cool.

Thanks a lot for the blog post. Want more.

Thanks again for the post.Really looking forward to read more. Want more.

Hey, thanks for the blog.Really thank you! Want more.

mexican border pharmacies shipping to usa: mexican border pharmacies shipping to usa – pharmacies in mexico that ship to usa

canada pharmacy online: canadian pharmacy sarasota – vipps canadian pharmacy

Right here is the perfect webpage for everyone who wishes to understand this topic. You realize a whole lot its almost hard to argue with you (not that I really will need to…HaHa). You certainly put a new spin on a subject that has been discussed for a long time. Great stuff, just excellent.

Im grateful for the blog post. Awesome.

canadian mail order pharmacy canadian pharmacy antibiotics canadian pharmacy mall

best india pharmacy: indian pharmacy online – top 10 online pharmacy in india

https://indiapharmast.com/# pharmacy website india

canadian pharmacy world reviews: canadian valley pharmacy – canadian pharmacy meds reviews

canadian pharmacy no scripts: canadian drug pharmacy – trusted canadian pharmacy

Thanks for the blog article.Really thank you! Much obliged.

canadian online drugstore legitimate canadian pharmacy real canadian pharmacy

best canadian online pharmacy: canadian pharmacy drugs online – canada cloud pharmacy

the canadian drugstore: online canadian pharmacy – canada drug pharmacy

http://indiapharmast.com/# best online pharmacy india

indian pharmacy paypal: top online pharmacy india – indian pharmacy online

Thank you for your blog article.Really thank you! Fantastic.

reputable mexican pharmacies online mexican pharmacy mexico drug stores pharmacies

buy medicines online in india: india pharmacy mail order – Online medicine order

best online pharmacy india: buy prescription drugs from india – Online medicine order

best canadian online pharmacy: legal to buy prescription drugs from canada – canadian drug pharmacy

https://canadapharmast.online/# canadian drug

https://doxycyclinedelivery.pro/# doxycycline 25mg tablets

where to buy amoxicillin: how to buy amoxicillin online – amoxicillin 500mg buy online uk

http://amoxildelivery.pro/# amoxicillin online no prescription

Say, you got a nice blog article. Will read on…

http://ciprodelivery.pro/# buy cipro online

Looking forward to reading more. Great post.Much thanks again. Will read on…

amoxicillin 500 mg for sale: amoxicillin price without insurance – where can i buy amoxicillin over the counter uk

I like your blog. It sounds every informative.

https://clomiddelivery.pro/# generic clomid no prescription

Your thing regarding creating will be practically nothing in short supply of awesome. This informative article is incredibly useful and contains offered myself a better solution to be able to my own issues. Which can be the specific purpose MY PARTNER AND I has been doing a search online. I am advocating this informative article with a good friend. I know they are going to get the write-up since beneficial as i would. Yet again many thanks.

http://doxycyclinedelivery.pro/# doxycyline

antibiotics cipro: ciprofloxacin generic price – ciprofloxacin order online

https://ciprodelivery.pro/# buy generic ciprofloxacin

This is one awesome blog article. Will read on…

cipro 500mg best prices: ciprofloxacin 500 mg tablet price – buy cipro without rx

https://amoxildelivery.pro/# where can i buy amoxicillin over the counter

Very neat article.Really looking forward to read more. Keep writing.

https://doxycyclinedelivery.pro/# doxycycline over the counter south africa

buy cipro without rx: purchase cipro – ciprofloxacin

http://clomiddelivery.pro/# cost of clomid without prescription

cost cheap clomid no prescription: how can i get generic clomid without dr prescription – where to buy clomid no prescription

I blog frequently and I really thank you for your information. This great article has truly peaked my interest. I will bookmark your blog and keep checking for new information about once per week. I opted in for your RSS feed too.

cipro for sale: buy cipro online canada – ciprofloxacin 500 mg tablet price

Thanks for sharing, this is a fantastic blog post.Really looking forward to read more. Really Great.

The condensation creates a vacuum seal between the lid and the rim

of the crock, which adds moisture to the food while serving to the

cooking course of — the lid is integral to the cooking process.

In some fashions, you can remove this cooking crock from the outer shell.

Not only can they determine which gender they need to keep things balanced, however they can even delay mating season till conditions are splendid.

Say, you got a nice blog.Thanks Again. Keep writing.

Great, thanks for sharing this post.Thanks Again. Great.

Very neat blog. Awesome.

Really appreciate you sharing this blog post.Thanks Again. Fantastic.

I thought it was going to be some boring old post, but I’m glad I visited. I will post a link to this site on my blog. I am sure my visitors will find that very useful.

Really enjoyed this blog post.Thanks Again. Much obliged.

This site definitely has all of the information I needed about this subject

My website: russkoeporno365

A round of applause for your blog. Great.

Wonderful article! We are linking to this great post on our site. Keep up the great writing.